Net Increase In Cash Formula

Cash Flow Statement

A reconciliation of the cash generated and used in a menstruation

What is the Cash Flow Argument?

A Cash Menstruation Statement (also called the Argument of Cash Flows) shows how much cash is generated and used during a given time flow. It is 1 of themain fiscal statements analysts use in building a three statement model. The main categories found in a cash flow statement are (1) operating activities, (two) investing activities, and (3) financing activities of a visitor and are organized respectively.

The total cash provided from or used by each of the three activities is summed to arrive at the total modify in greenbacks for the period, which is then added to the opening cash balance to arrive at the cash menstruum statement's bottom line, the closing greenbacks residue.

One of the primary reasons greenbacks inflows and outflows are observed is to compare the cash from operations to internet income. This comparing helps company management, analysts, and investors to gauge how well a company is running its operations. The cash flow argument reflects the bodily amount of money the company receives from its operations.

The reason for the difference between greenbacks and profit is because the income statement is prepared under the accrual basis of bookkeeping, where it matches revenues and expenses for the accounting menstruation, even though revenues may really not have all the same been collected and expenses may not accept withal been paid. In contrast, the greenbacks flow statement just recognizes cash that has really been received or disbursed.

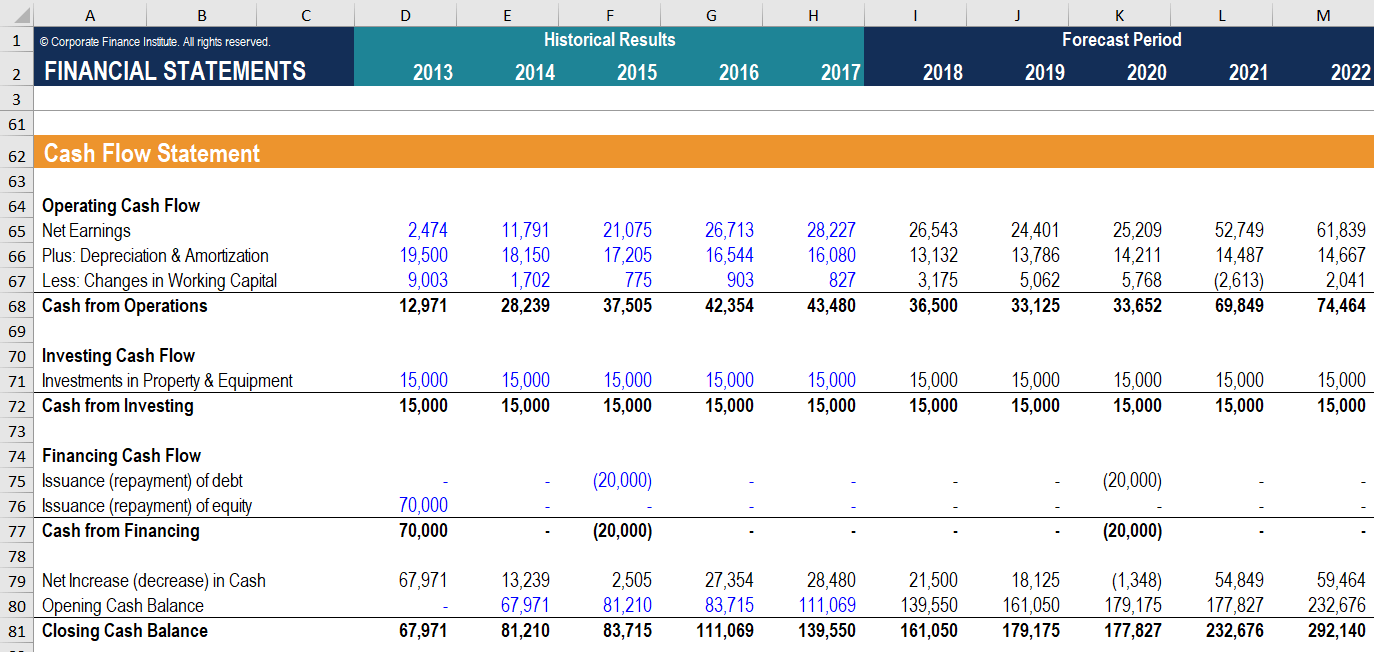

Image: CFI Financial Modeling Courses.

Download the Complimentary Template

Enter your name and electronic mail in the course beneath and download the free template now!

How to Prepare the Cash Flow Statement?

Below is a breakdown of each section in a statement of cash flows. While each company will accept its own unique line items, the general setup is commonly the aforementioned. This guide will requite you lot a skilful overview of what to look for when analyzing a company.

#one Operating Cash Flow

The greenbacks flow statement begins with Cash Catamenia from Operating Activities. It starts with net income or loss, followed by additions to or subtractions from that amount to adjust the net income to a total cash flow figure. What is added or subtracted are changes in the account balances of items establish in current assets and electric current liabilities on the rest sheet, as well as non-cash accounts (e.yard., stock-based compensation). Nosotros then arrive at the cash version of a company's internet income.

Net Earnings

This amount is the bottom line of an income statement. Cyberspace income or earnings shows the profitability of a company over a period of time. Information technology is calculated past taking total revenues and subtracting from them the COGS and total expenses, which includes SG&A, Depreciation and Amortization, involvement, etc.

Plus: Depreciation and Amortization (D&A)

The value of various assets declines over fourth dimension when used in a business. As a result, D&A are expenses that allocate the toll of an asset over its useful life. Depreciation involves tangible avails such as buildings, machinery, and equipment, whereas acquittal involves intangible avails such as patents, copyrights, goodwill, and software. D&A reduces net income in the income statement. Even so, we add together this dorsum into the cash catamenia statement to suit cyberspace income considering these are non-cash expenses. In other words, no cash transactions are involved.

Less: Changes in working capital

Working upper-case letter represents the difference between a company'south electric current avails and current liabilities. Whatever changes in current assets (other than cash) and current liabilities bear on the cash residual in operating activities.

For example, when a company buys more inventory, current assets increment. This positive change in inventory is subtracted from net income because it is seen as a cash outflow. It'southward the same case for accounts receivable. When information technology increases, it means the company sold their goods on credit. At that place was no cash transaction, so accounts receivable is also subtracted from net income.

On the other hand, if a current liability item such equally accounts payable increases, this is considered a cash inflow because the company has more than greenbacks to keep in its business. This is then added to cyberspace income.

Cash from operations

When all the adjustments accept been fabricated, we arrive at the internet cash provided past the company'southward operating activities. This is non a replacement for net income, merely rather a summary of how much cash is generated from the company's core concern.

#2 Investing Cash Flow

This category on the argument of cash flows is referred to as Cash Flow from Investing Activities and reports changes in uppercase expenditures (CapEx) and long-term investments. CapExcan refer to the purchase of belongings, plant, or equipment assets. Long-term investments may include debt and equity instruments of other companies. Another of import detail constitute here is acquisitions of other businesses. A key to remember is that a change in the long-term avails in the residue sheet is reported in the investing activities of the cash flow statement.

Investments in Property and Equipment

These CapEx investments might mean purchases of new part equipment such as computers and printers for a growing number of employees, or the purchase of new land and a building to house business operations and logistics of the company. These items are necessary to keep the company running. These investments are a cash outflow, and therefore will accept a negative impact when nosotros calculate the net increase in cash from all activities. Learn how to calculate CapEx with the CapEx formula.

Greenbacks from investing

This is the full amount of cash provided by (used in) investing activities. In our example, nosotros have a internet outflow for each and every twelvemonth.

#3 Financing Cash Menses

This category is also called Cash Flow from Financing Activities and reports any issuance or repurchases of stocks and bonds of the company, besides as whatsoever dividend payments it makes. The changes in long-term liabilities and stockholders' equity in the balance sheet are reported in financing activities.

Issuance (repayment) of debt

A company issues debt every bit a way to finance its operations. The more greenbacks it has, the meliorate, as information technology will be able to expand apace. Dissimilar equity, issuing debt doesn't grant any ownership interest in the company, and then it doesn't dilute the buying of existing shareholders. The issuance of debt is a cash inflow, considering a visitor finds investors willing to act as lenders. All the same, when these investors are paid back, then the debt repayment is a cash outflow.

Issuance (repayment) of disinterestedness

This is another way of financing a company's operations. Unlike debt, equity holders have some ownership stake in the business in exchange for money given to the visitor for use. Future earnings must exist shared with these equity holders or investors. Issuance of equity is an additional source of cash, so information technology's a greenbacks inflow. Conversely, an equity repayment is a cash outflow. This is buying back, through greenbacks payment, the equity from its investors and thereby increasing the stake held by the company itself.

Cash from financing

This is likewise called the net cash provided by (used in) financing activities. The cash from financing is calculated by summing up all the cash inflows and outflows related to changes in long-term liabilities and shareholders' equity accounts.

#4 Cash Remainder

The concluding section on the statement of cash flows is a reconciliation of the total greenbacks position, which connects to the balance sheet. This is the final piece of the puzzle when linking the three financial statements.

Internet Increase (decrease) in Cash and Endmost Greenbacks Residue

In one case we have all net cash balances for each of the three sections of the cash menstruation argument, nosotros sum them all up to observe the internet cash increment or decrease for the given time menses. Nosotros and then have this amount and add it to the opening cash rest to eventually get in at the endmost greenbacks rest. This corporeality volition be reported in the remainder sheet statement under the current asset department.

Opening cash remainder

The opening cash balance is last year's closing greenbacks residual. We can find this corporeality from last year's cash flow statement and remainder sail statement.

Real-Life Example of a Cash Flow Statement (Amazon)

Below is an example of Amazon's 2016 statement of cash flows. Equally yous can see by the orange rectangles, in that location are 3 articulate sections that add together to the total change and terminate of flow cash position. For a closer look, you tin can download Amazon'due south fiscal statements hither, or you tin can check out CFI's Avant-garde Financial Modeling Class on Amazon.

How to Build a Statement of Cash Flows in a Financial Model

A cash menses statement in a fiscal model in Excel displays both historical and projected data. Before this model tin can be created, we first need to have the income statement and residue sheet statement models built in Excel, since their data will ultimately drive the greenbacks period statement model.

Image: CFI Financial Modeling Courses.

Every bit nosotros take seen from our financial model example, it shows all the historical data in a blue font, while the forecasted data appears in a black font. The figure below only serves as a general guideline as to where to notice historical data to hardcode for the line items. Additionally, it shows where we notice, in the financial model, the calculated or reference data to make full upward the forecast period section.

When all iii statements are built in Excel, we now accept what we call a "Three Statement Model". Below is a summary of how to build a statement of cash flows in Excel.

| Line Items | Historical Results (Annual Study) | Forecast Periods (Model) |

|---|---|---|

| Net Earnings | Income Statement | Income Statement |

| Depreciation & Acquittal | Income Statement | PP&E Schedule |

| Changes in Working Uppercase | Residual Sheet | Working Capital Schedule |

| Capital Expenditures | Balance Sheet | PP&East Schedule |

| Debt Issuance | Balance Sheet | Debt Schedule |

| Equity Issuance | Balance Canvass | Equity Schedule |

| Opening Cash Balance | Prior Period Residual Sail | Prior Menstruum Balance Sail |

Video Explanation of the Cash Catamenia Statement

Watch this curt video to speedily sympathise the main concepts covered in this guide, including what the cash menstruum statement is, how it works, and about importantly, why it matters to finance professionals.

Additional Resource

Thank yous for reading CFI'south guide to agreement how the cash catamenia argument works. To continue learning and advancing your career equally a professional financial annotator, these additional CFI resource will exist helpful:

- Residual Sheet Overview

- Income Statement Overview

- What is a Financial Model?

- Height Financial Analyst Certifications

Net Increase In Cash Formula,

Source: https://corporatefinanceinstitute.com/resources/knowledge/accounting/cash-flow-statement/

Posted by: nolanheigher.blogspot.com

0 Response to "Net Increase In Cash Formula"

Post a Comment